The Lifespan of a Business: recognising when to wind down

When we think about the lifespan of a business, we less commonly think about the end of the cycle. Nevertheless, it is a critical phase: business life spans have shortened dramatically in the last 100 years. In this rapidly changing environment, being able to recognise and bring a business's life span to an end is in fact a key business skill and not a terminal failure.

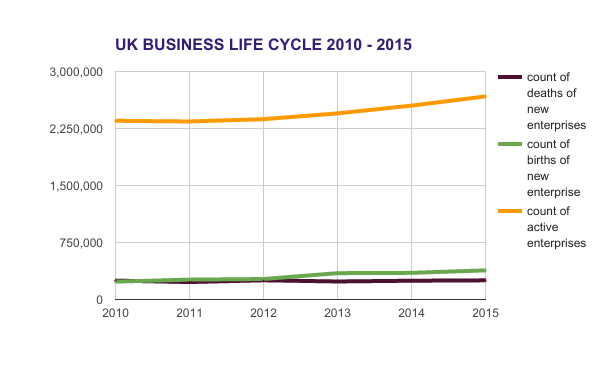

ONS data tells us that in 2015 there were almost 2.7million active businesses operating in the UK, and year on year there has been a steady increase in the number of businesses operating in the UK since 2011. This has increased at a higher rate - by approximately 100,000 each year - post 2012.

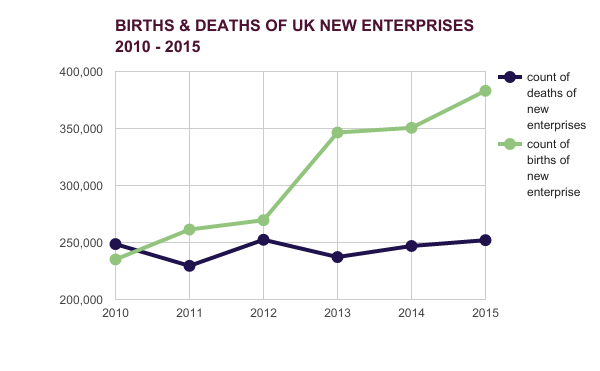

The data also shows that since 2012, more new businesses have been incorporated each year than have closed. If we dig into thisdata, we can see that since 2012 the number of new enterprises incorporated in the UK has risen by almost 70%, whilst the rate of new business death has actually remained reasonably constant since 2010.

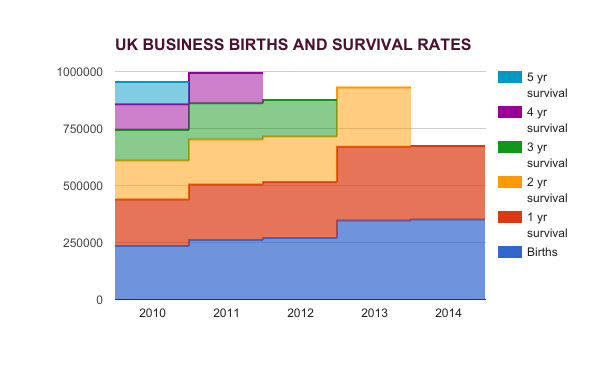

However, if we look at the survival rates of new businesses for the first 5 years of life after incorporation, we see from the available data of businesses started each year since 2010, approximately:

● 91 - 93% of businesses survived the first year

● 73 - 75% of businesses survived their second year

● 59 - 60% of businesses survived into their third year

● 48 - 51% of businesses survived into their fourth year

● 40% of businesses survived into their fifth year.

What the data is telling us, is that for many, business lifespans are short. In fact, business lifespans have shortened dramatically across the board in relatively recent years. When we think about such data, there might be a tendency or a desire to focus on the ‘successful’ 40%, to focus on or idealise businesses with the greatest longevity. But if we do that, we risk overlooking or failing to understand a critical aspect of today’s business climate. A more rapid turnover of businesses is a natural response to dramatic environmental changes that have occurred, and will continue to occur. Whether we analyse change through the lenses of mega trends: resource scarcity, technological breakthroughs and development, or change in economic power structures, the fact remains that a shorter business lifecycle is a persistent trend. What matters is how we view and respond to it.

There is no one size fits all approach. Whilst for some, business longevity might be desirable, for others setting up and selling a business in 3 years is positively aspirational - think of some social media, tech enterprise, and the transition to an online economy. Nevertheless, regardless of the planned longevity of the business, realistic assessments of the business’s viability will determine its actual lifespan. Fortunately, we are lucky to be working towards a business culture in which innovation, endeavour and critically, failure are supported. Failure is a concept that we are becoming more able to accept in the UK. As it is becoming easier and cheaper to set up a business, and technology is changing the landscape of what’s possible, it’s inevitable and to some extent desirable that business failure rates will increase. The need to continually adapt, restructure and reincarnate businesses is a given as business models are necessarily tailored to changing conditions.

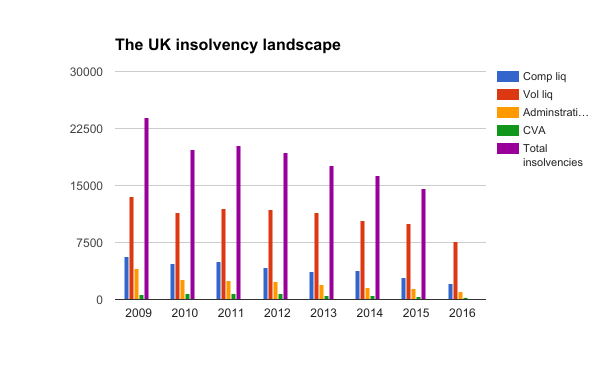

UK insolvency rates have been in gradual decline since 2011 and in the last couple of years have levelled off at around 15,000 insolvencies per year. (We don’t yet have all the figures for 2016, but we expect it to remain at a similar rate to 2015). Of all insolvency procedures, voluntary liquidation is by far the most common - half or more than half of all insolvency procedures are voluntary liquidations. Whilst the macro environment is undergoing dramatic change, the nature of human life cycles and relationships, in some senses, changes relatively little. We consistently find that the reasons for individual business liquidations remain substantially the same in modern times: economic factors, illness of key directors and bad debts, for example. Fortunately, our UK liquidation procedures are set up to best aid rather than penalise and stigmatise the responsible entrepreneur.

There are online tools available that analyze all aspects of your business in order to predict how much liquidation or prepack might cost you. Our voluntary liquidation calculator takes into consideration like; how many businesses you owe money to, your assets and many other factors to give you an estimated quote.

Recent UK legislation continues to make liquidation a more flexible procedure for an entrepreneurially attractive business environment. At the end of the day, if a business can’t make money nor continually meet its liabilities, it isn’t viable. It is important to be able to cut your losses and move on or where possible, try again. Our UK insolvency procedures are amongst some of the most progressive in the world at supporting business innovation, using them correctly is a restructuring skill, not a terminal failure.

Eamonn Wall is Managing Director of Robson Scott Associates, a leading independent Insolvency Practice in the North East of England. For more information on business recovery and rescue, visit Business Rescue Expert

Delicious

Delicious Digg

Digg StumbleUpon

StumbleUpon Propeller

Propeller Reddit

Reddit Magnoliacom

Magnoliacom Newsvine

Newsvine

Comments

Post new comment