SWOT! How to Avoid the Really Big Mistakes

When DreamWorks creative superstars Steven Spielberg and David Geffen announced they were not going to renew their contract with parent company Viacom’s Paramount Studios last year, it made the news everywhere here in Los Angeles. Viacom CEO Philippe Dauman told the press the loss would be “completely immaterial” to his company.

Was this a bluff? Or did Dauman not research the potentially catastrophic effects that losing this talent might have on his movie empire? Consider the hits to come out of DreamWorks over the past few years: Shrek, The Ring, Madagascar, Saving Private Ryan … the list goes on.

The message? Even executives who run big businesses can make errors in judgment.

SWOT: A Proven Planning Tool

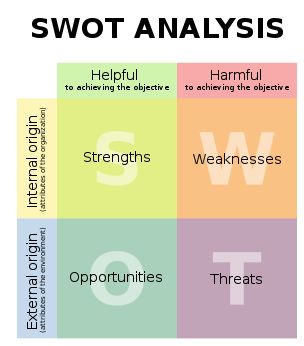

On a different scale, many owners of smaller companies commit the same error every day—making decisions without doing adequate homework. The best “homework” a small business owner can do is what’s called a SWOT analysis. This is a proven strategic planning tool that gives an organization critical visibility into its internal Strengths and Weaknesses and its external Opportunities and Threats.

On a different scale, many owners of smaller companies commit the same error every day—making decisions without doing adequate homework. The best “homework” a small business owner can do is what’s called a SWOT analysis. This is a proven strategic planning tool that gives an organization critical visibility into its internal Strengths and Weaknesses and its external Opportunities and Threats.

The bravado expressed by Viacom’s boss may be the leading indicator of a bad decision that could ultimately impact the company’s bottom line severely. Decisions by small company CEOs who don’t have the benefit of SWOT insights can be even more costly. However, their lack of financial depth may not allow as much room for errors in judgments as a large corporation like Viacom has.

What kinds of unique insights might a SWOT analysis provide?

Strengths: It will force you to take a good hard look at your assets as a company, the things you do better than anyone else, and the skills you and your employees possess—skills that are more leading edge, brilliant or simply more efficient than your competitors. These skills can be leveraged into gains in the marketplace if employed properly.

Weaknesses: In your analysis, you’ll take an even harder look at your company’s liabilities and the areas where you are vulnerable to challenges by competitors. This could be weak customer service, products that aren’t keeping up with changing demand, or a pricing structure that doesn’t recognize where the market is going.

Opportunities: Your analysis may reveal openings in the marketplace where you can take advantage of events and circumstances outside the company, such as the weaknesses of key competitors or the sudden appearance of a market need that you can address before your competitors recognize it.

Threats: It could also give warning of the looming entry into your market of a category-killing competitor, like a Wal-Mart offering generic prescriptions for $4, an Amazon.com selling books online at below-bookstore prices, or an internet telephone service taking a big bite out of traditional phone company revenues.

Don’t Be Blindsided

These are examples we read about in the newspapers, but every day small business owners are blindsided by things just like this in their own companies that they might have seen coming if they had looked closely enough.

Performing a SWOT analysis is not difficult, although it does require a certain objectivity about things we don’t always want to hear. Perhaps Mr. Dauman should have taken a closer look: In the motion picture release schedule for 2009, most of the films were DreamWorks’, not Paramount’s. Interesting.

These days, all CEOs should take a very close look at the businesses they run and ask themselves if they really understand their SWOTs, and if they are confident that their strategic initiatives are crafted appropriately.

Gene Siciliano, CMC, CPA, is an author, speaker and financial consultant who works with CEOs and managers to achieve greater financial success in a dramatically changing economy. As “Your CFO For Rent” and president of Western Management Associates, Gene has spent more than 23 years helping his clients build financial strength and shareholder value through applied knowledge and process improvement. His best selling book, “Finance for Non-Financial Managers,” (McGraw-Hill, 2003) is available in bookstores and online. More information and free articles are available at www.GeneSiciliano.com.

Gene Siciliano, CMC, CPA, is an author, speaker and financial consultant who works with CEOs and managers to achieve greater financial success in a dramatically changing economy. As “Your CFO For Rent” and president of Western Management Associates, Gene has spent more than 23 years helping his clients build financial strength and shareholder value through applied knowledge and process improvement. His best selling book, “Finance for Non-Financial Managers,” (McGraw-Hill, 2003) is available in bookstores and online. More information and free articles are available at www.GeneSiciliano.com.

Delicious

Delicious Digg

Digg StumbleUpon

StumbleUpon Propeller

Propeller Reddit

Reddit Magnoliacom

Magnoliacom Newsvine

Newsvine

Comments

Post new comment