5 Compliance Mistakes That Can Ruin Your Startup

Starting a small business or a startup is riddled with rules and regulations, with paperwork and deadlines. Especially if this is your first time starting a business, there are many aspects to it that can cost you time, money and even your sleep.

Starting a small business or a startup is riddled with rules and regulations, with paperwork and deadlines. Especially if this is your first time starting a business, there are many aspects to it that can cost you time, money and even your sleep.

From employment contracts to safety regulations or small business surety bonds, all of these can result in compliance mistakes if you're not careful. Here is a list of 5 common compliance mistakes for you to watch out for when starting your own business.

1. Not Choosing the Proper Company Structure

If, in rushing to start your business, you choose the wrong company structure, you could end up having to pay higher taxes or struggle with operating the business properly with your partners. For this reason, before you do anything else, consider which company structure will be right for your small business or startup.

The options that are available for small businesses are:

● Sole proprietorships

● General partnerships

● LLC (Limited Liability Company)

● C corporations or S corporations

● Limited partnerships

To choose the right company structure, it is best to get legal advice and discuss the matter with anyone else who will be involved in the business.

2. Losing or Lacking Proper Employment Documentation

Proper employment documentation is a must. But even if you've taken care of the legal minimum you may still run into difficulties.

This includes:

● USCIS I-9 Employment Eligibility Verification Forms to verify employee identities and eligibility to work

● IRS W-4 Forms that establish tax withholding amounts

● Employment application forms that include detailed information about employees, such as criminal background checks or notices of at-will employment

● Proper employee status classification according to the Fair Labor Standards Act (FLSA)

● Benefit forms detailing the various benefits available to employees and their families

● Employee handbook specifying company policies, procedures, best practices, safety and health rules, etc.

3. Not Renewing or Obtaining Your Small Business Surety Bonds

Many different businesses need to obtain a surety bond when getting their professional license.

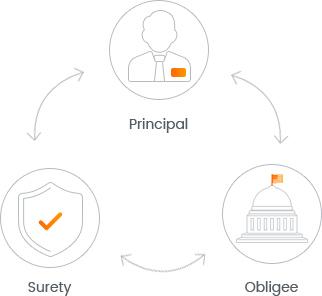

New and small businesses often struggle understanding the bonding process as well as how claims can be filed against them. Small business surety bonds are a form of financial guarantee, which works as a contractual agreement between three parties, where the principal is the business owner.

Image source: What is a surety bond? / Bryant Surety Bonds

A common compliance mistake related to surety bonds is not paying attention to when a business needs to renew their bond in order to remain licensed. Typically license bonds need to be renewed once a year or, depending on state regulations, once every two years. Not renewing your bond can result in having your license revoked, so it is key that bonds are renewed on time.

4. Making Mistakes When Preparing Taxes

Taxes are another area where small or new businesses may make mistakes that can cost them dearly down the road. Common tax-related mistakes are related to:

● Calculating the proper deductions for the business

● Properly separating personal and business accounts

● Being on time with payroll, local taxes, excise tax, self-employment taxes and others

● Properly depositing payroll taxes

● Keeping good records in order to reduce taxable income

● Knowing which taxes the business is exposed to

All of this can incur fines and penalties if you do not pay attention, miss payments or mix up your finances. As with all of the above points here, too, it would be best for you to work with professionals, such as accountants and payroll companies, who can keep your track of your payroll or properly calculate your taxes and deductions.

5. Not Complying With Occupational Safety and Health Administration (OSHA) Regulations

OSHA compliance rules should be central to you, as you start employing people in your business. Providing a workplace that is safe and free from hazards, establishing safety procedures, maintaining equipment, communicating safety guidelines in a comprehensive way - all of this is a must.

To further comply with OSHA regulations or even go beyond basic compliance, you should consider safety training programs if your business presents a lot of potential hazards and workplace incidents. You should also conduct regular safety inspections to be sure that you remain compliant as well as take measures if employees violate safety measures.

Additional compliance is secured by keeping records of disciplinary actions taken against employees that violate measures. Records of accidents as well as material safety data sheets should also be kept in order to avoid any cause for concern or penalties when an inspection is conducted.

Which Other Compliance Mistakes Should SMBs and Startups Look out For?

What’s your experience with the above compliance mistakes? Leave us a comment, we'd like to know what you think!

Todd Bryant is the president and founder of Bryant Surety Bonds. He is a surety bonds expert with years of experience in helping business owners get bonded and start their business.

Delicious

Delicious Digg

Digg StumbleUpon

StumbleUpon Propeller

Propeller Reddit

Reddit Magnoliacom

Magnoliacom Newsvine

Newsvine

Comments

Post new comment